Advantages and Disadvantages of Cryptocurrency Trading in Bl

- By tokenim钱包官网下载

- 2025-11-05 15:56:31

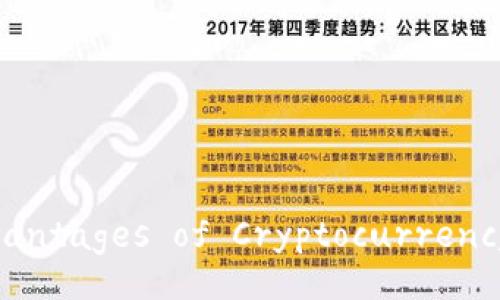

The blockchain technology is a revolutionary approach to data management that assures transparency, security, and decentralization. Within this framework, cryptocurrencies—digital or virtual currencies that use cryptography for security—have gained immense popularity as a financial asset. Cryptocurrency trading involves buying and selling these digital currencies with the goal of making a profit. The explosive growth in the cryptocurrency market has attracted a wide range of investors, prompting a closer look at the advantages and disadvantages of engaging in this form of trading.

### Advantages of Cryptocurrency Trading #### 2.1 Accessibility and TransparencyOne of the primary advantages of cryptocurrency trading is its accessibility. Anyone with an internet connection can buy and sell cryptocurrencies without the need for traditional banking systems. This democratization of finance allows individuals from various socio-economic backgrounds to participate in the market. Furthermore, blockchain technology ensures a high level of transparency by allowing all transactions to be recorded and observed on a public ledger, thus reducing fraud risks.

#### 2.2 Potential for High ReturnsCryptocurrencies are known for their potential to generate significant returns due to their volatility. Investors can capitalize on price swings over short periods, leading to substantial profits. Historical data showcases numerous instances where early investors in bitcoin and other cryptocurrencies have seen their investments multiply exponentially, attracting speculative traders aiming for similar gains.

#### 2.3 Diversification of Investment PortfolioIncorporating cryptocurrencies into an investment portfolio can offer diversification benefits. As a relatively new asset class, cryptocurrencies often exhibit low correlation with traditional assets like stocks and bonds. This means that during times of economic downturns, cryptocurrencies may perform differently, thus balancing overall investment risk.

#### 2.4 24/7 Market OperationUnlike traditional financial markets, cryptocurrency exchanges operate around the clock, allowing traders to engage at any time. This continuous trading environment provides flexibility and opportunities for day traders and those who prefer to manage their investments actively without being tied to specific market hours.

#### 2.5 Decentralization and SecurityThe decentralization of cryptocurrencies means that they are not controlled by any single entity, such as a government or financial institution. This reduces the risk of centralized failures and censorship. Additionally, the cryptographic techniques used in securing blockchain transactions enhance security, making unauthorized access to funds very difficult.

### Disadvantages of Cryptocurrency Trading #### 3.1 Price VolatilityWhile volatility offers high return possibilities, it also poses significant risks. Cryptocurrency prices can fluctuate wildly based on market sentiment, regulatory news, and technological advancements. For inexperienced traders, such volatility can lead to substantial losses if not managed carefully.

#### 3.2 Regulatory RisksThe regulatory landscape for cryptocurrencies is still evolving, which can create uncertainty for traders. Governments around the world are grappling with how to treat cryptocurrencies, leading to sudden changes in regulations that can significantly affect trading. For instance, a country might ban cryptocurrency transactions overnight, leaving traders in a lurch.

#### 3.3 Security Concerns and Hacking IssuesDespite the high level of security associated with blockchain technology, cryptocurrency exchanges and wallets can be vulnerable to hacks. Prominent security breaches have led to substantial losses for traders, raising concerns about the safety of investing in cryptocurrencies. It is crucial for traders to use secure platforms and practices to mitigate this risk.

#### 3.4 Lack of Consumer ProtectionsUnlike traditional banking and financial institutions, the cryptocurrency market lacks robust consumer protection measures. There are limited avenues for recourse in the event of fraud or theft, leaving traders vulnerable. This can be particularly concerning for novice traders who may not fully understand the risks involved.

#### 3.5 Psychological Factors in TradingEmotional decision-making can significantly impact trading success. Investors might make impulsive decisions based on fear or greed, leading to poor trading outcomes. The fast-paced environment of cryptocurrency trading can exacerbate these psychological factors, making it essential for traders to develop strategies to manage their emotions effectively.

### ConclusionAs the cryptocurrency market continues to evolve, understanding the advantages and disadvantages of trading in this space is vital for anyone considering entering it. While the potential for high returns, accessibility, and market transparency are compelling reasons to engage in cryptocurrency trading, the volatility, regulatory risks, and security concerns represent significant challenges. Prospective traders must weigh these factors carefully and adopt responsible trading practices to navigate the complexities of this burgeoning financial landscape.

### Related Questions #### 5.1 What is the difference between trading cryptocurrencies and traditional stocks?The world of finance offers multiple avenues for investment, with two of the most prominent being cryptocurrency trading and traditional stock trading. Both avenues possess unique characteristics, risks, and opportunities. Understanding these differences can significantly impact an investor's success. One of the primary differences lies in market structure. While stock markets operate during specific hours and are subject to regulations by authorities like the Securities and Exchange Commission (SEC), cryptocurrency markets function round-the-clock, providing continuous trading opportunities. This perpetuity can lead to heightened volatility, making cryptocurrencies more prone to dramatic price swings than traditional stocks. Another difference is in the underlying asset itself. Stocks represent ownership in a company, offering dividends or profits, while cryptocurrencies represent digital assets or utility coins within decentralized networks. This distinction underscores the importance of understanding the fundamental value behind each investment. Additionally, the ease of access to trading platforms has democratized investment in cryptocurrencies, allowing virtually anyone with internet access to begin trading. Conversely, trading stocks may require a more formal brokerage setup and adherence to specific regulations. Furthermore, cryptocurrencies often come with fewer protections for investors compared to stocks, leading to higher risks in the crypto space. As a result, the choice between trading cryptocurrencies and stocks should be based on an individual's investment goals, risk tolerance, and understanding of each market.

#### 5.2 How should one prepare for cryptocurrency trading?Entering the world of cryptocurrency trading requires thorough preparation and a clear understanding of the market dynamics. Here are several essential steps prospective traders can take to set themselves up for success. First and foremost, extensive research is paramount. Familiarizing oneself with fundamental concepts such as blockchain technology, different cryptocurrencies, and market trends is crucial. Many resources such as online courses, webinars, and articles are available to aid in understanding these complex topics. Secondly, creating a solid trading plan is vital for navigating the volatile landscape. This plan should include clear objectives, risk management strategies, and entry and exit criteria for trades. This structured approach can help mitigate impulsive decision-making, particularly during periods of heightened market activity. Additionally, leveraging technology is essential for modern traders. Utilizing trading platforms that offer real-time price tracking, advanced charting tools, and algorithmic trading options can streamline the trading process. Furthermore, having a secure wallet for storing cryptocurrencies is critical to protect assets from potential hacks or theft. Engaging with the broader cryptocurrency community can provide valuable insights and networking opportunities. Participating in forums, social media platforms, or local meetups can help traders stay updated on the latest developments and trends. Finally, recognizing that psychology plays a significant role in trading is crucial. Maintaining discipline and emotional control can be challenging, particularly in a market characterized by fear and greed. Investors can benefit from practicing mindfulness techniques or developing a system to assess their emotional state before executing trades. Overall, comprehensive preparation is key to navigating the cryptocurrency trading landscape effectively.

#### 5.3 Is cryptocurrency trading suitable for beginners?The question of whether or not cryptocurrency trading is suitable for beginners elicits various opinions. On one hand, the cryptocurrency market offers a low barrier to entry, thanks in part to the proliferation of user-friendly trading platforms and educational resources. Beginners can start trading with relatively small investments, allowing them to learn the ropes without risking substantial capital. Additionally, the abundance of information available online makes it possible for novices to gain knowledge quickly about various cryptocurrencies and trading strategies. However, the volatile nature of cryptocurrencies poses significant risks that a beginner should consider. New traders may experience emotional turmoil when confronted with rapid market fluctuations or unexpected losses, making it crucial for them to develop a sound trading strategy and adhere to risk management principles. Moreover, the lack of regulatory protections in the cryptocurrency space exposes beginners to potential fraud and scams. For those just starting, it is imperative to conduct thorough research, choose reputable trading platforms, and stay informed about security practices. Ultimately, while cryptocurrency trading can be accessible to beginners, it requires a willingness to learn, patience, and commitment to managing risks. With the right mindset and preparation, beginners can navigate this complex market and potentially reap its rewards.

#### 5.4 What are the common mistakes to avoid in cryptocurrency trading?While trading in cryptocurrencies provides potential for profit, it also involves numerous pitfalls that traders must navigate. Awareness of common mistakes can empower investors to avoid costly errors. One prevalent mistake is neglecting adequate research. Many traders, lured by the excitement of potential profits, often dive into trading without understanding the fundamentals of the cryptocurrencies they are dealing with. Comprehensive research is vital to comprehend market trends, technology, and the specific use case of each cryptocurrency. Another common error occurs during neglecting risk management. Many traders fail to set stop-loss orders or over-invest in a single cryptocurrency, exposing themselves to substantial risks. Establishing a well-defined risk management strategy can significantly minimize potential losses. Emotional decision-making is another trap traders frequently fall into. Factors such as fear, greed, and panic can lead to impulsive decisions, resulting in poor trading outcomes. Maintaining a disciplined approach and adhering to a predefined trading plan can mitigate emotional influences. Furthermore, overlooking security practices can put holdings in jeopardy. Many traders do not implement proper security measures, such as using hardware wallets or enabling two-factor authentication on trading accounts, making them susceptible to hacks. Finally, traders should avoid chasing after the latest trends without due diligence. New projects or coins can emerge rapidly, but investing based solely on hype can lead to devastating losses. Thoroughly assessing the legitimacy and potential of a cryptocurrency is essential before investing. In summary, awareness of these common mistakes can empower traders to build more robust strategies, protect their investments, and maximize their opportunities in the cryptocurrency market.

#### 5.5 How can one develop a successful trading strategy?Building a successful trading strategy in the cryptocurrency market requires careful planning, discipline, and continual improvement. A well-defined trading strategy serves as a roadmap, guiding a trader's decisions and actions in various market conditions. The first step in developing a trading strategy is defining clear goals and objectives. This may entail setting specific profit targets, determining acceptable risk levels, and establishing timeframes for both short-term and long-term trading. With clear goals in mind, traders can better structure their approach. Furthermore, establishing a trading methodology is crucial. Traders can choose various approaches, such as technical analysis, fundamental analysis, or sentiment analysis, to inform their decisions. Technical analysis involves studying price charts, identifying patterns, and utilizing indicators to predict future price movements. Conversely, fundamental analysis delves into the underlying factors affecting a cryptocurrency's value, such as technological developments, partnerships, and market demand. Once a strategy is in place, risk management becomes paramount. This includes setting stop-loss orders to minimize potential losses, determining position sizes according to risk tolerance, and diversifying investments to spread risk across multiple assets. Moreover, regularly evaluating and adapting one's strategy is essential, as market conditions are constantly changing. Successful traders are often those who can learn from past experiences, analyze performance metrics, and adjust their strategies accordingly. Finally, psychological discipline plays a vital role in execution. Traders should remain aware of their emotions and adhere to their plans, avoiding the temptation to deviate based on market fluctuations. By integrating these components, traders can develop a comprehensive and effective strategy tailored to their individual styles and preferences.

#### 5.6 What impact do market trends have on cryptocurrency trading?The influence of market trends on cryptocurrency trading is both significant and multifaceted. Understanding these trends can empower traders to make informed decisions and capitalize on emerging opportunities. Market trends reflect the collective sentiment and behavior of participants, shaping price movements and overall market direction. One critical trend to observe is bullish and bearish cycles, which are characterized by rising and falling prices, respectively. A bullish market often leads to heightened trading activity, as investors rush to capitalize on perceived opportunities for profit. Conversely, a bearish trend can freeze trading activity as investors become cautious and reassess their positions. Additionally, broader economic trends can play an essential role in shaping the cryptocurrency market. For instance, macroeconomic indicators such as inflation rates, economic growth, and monetary policy decisions can impact investor sentiment and lead to shifts in cryptocurrency demand. Furthermore, technological developments and advancements within the cryptocurrency space can drive trends. Innovations such as the introduction of new blockchain protocols, upgrades to existing networks, or the emergence of decentralized finance (DeFi) can significantly shape trading activity and influence investors' decisions. Social media and news coverage also have a considerable impact on market trends. Positive news regarding regulatory developments or institutional adoption can drive prices up, while negative news such as hacks or regulatory crackdowns can lead to sharp downturns. Ultimately, seasoned traders closely follow market trends, employing various tools and analytics to analyze sentiment and identify potential entry and exit points for trades. By understanding and reacting to market trends, cryptocurrency traders can enhance their trading strategies and potentially improve their outcomes.

--- This structured approach will help you provide comprehensive insights on cryptocurrency trading, addressing user queries and following practices effectively.